Commentary on 2024 Half-Year Performance - Izwe Loans Zambia

7 AUGUST 2024 : 12:00AM

lungungosa@gmail.com

The Board of Directors of Izwe Loans Zambia Plc (the “Company” or “Izwe”) are pleased to present the condensed unaudited financial results for the period ended 30 June 2024. This publication does not contain full or complete disclosure details.

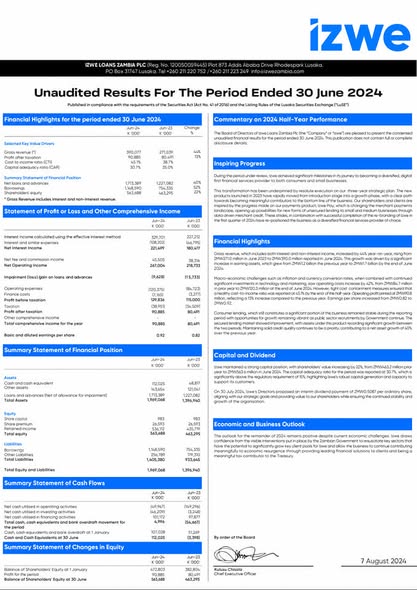

Financial Highlights

Gross revenue, which includes both interest and non-interest income, increased by 44% year-on-year, rising from ZMW271.0 million in June 2023 to ZMW390.0 million reported in June 2024.

This growth was driven by a significant increase in earning assets, which grew from ZMW1.2 billion the previous year to ZMW1.7 billion by the end of June 2024. Macro-economic challenges such as inflation and currency conversion rates, when combined with continued significant investments in technology and marketing, saw operating costs increase by 42%, from ZMW84.7 million. In prior year to ZMW120.3 million at the end of June 2024. However, tight cost containment measures ensure that a healthy cost-to-income ratio was reported at 45.1% by the end of the half-year. Operating profit printed at ZMW90.8 million, reflecting a 13% increase compared to the previous year.Earnings per share increased from ZMW0.82 to ZMW0.92.

Consumer lending, which still constitutes a significant portion of the business remained stable during the reporting period with opportunities for growth remaining vibrant as public sector recruitments by Government continue. The secured lending market showed improvement, with assets under this product recording significant growth between the two periods. Maintaining solid credit quality continues to be a priority, contributing to a net asset growth of 40% over the previous year.

Featured Image

2024-08-07

Category: Economic and Business Sectors