A K49 Billion VAT Refund Crisis Choking the Life Out of Manufacturers

13 JANUARY 2024 : 12:00AM

Gerald Hamuyayi

Unremitted Value Added Tax (VAT) refunds are creating a growing financial strain on Zambia's manufacturing sector, hindering its operational efficiency and long-term growth potential. Delays in refunding VAT credits due to systemic inefficiencies and resource constraints have turned a tax meant to incentivise production into a punitive burden on businesses. This article draws insights from a report by Muntanga Lindunda, Zondwayo Duma, Jiholola Kabandala, Michelo Maunga, and Leticia Chisanga, based on a survey of manufacturers conducted under the umbrella of the United States Agency for International Development (USAID) and Zambia Association of Manufacturers (ZAM). It further offers a critique of the report's recommendation on securitisation of VAT arrears.

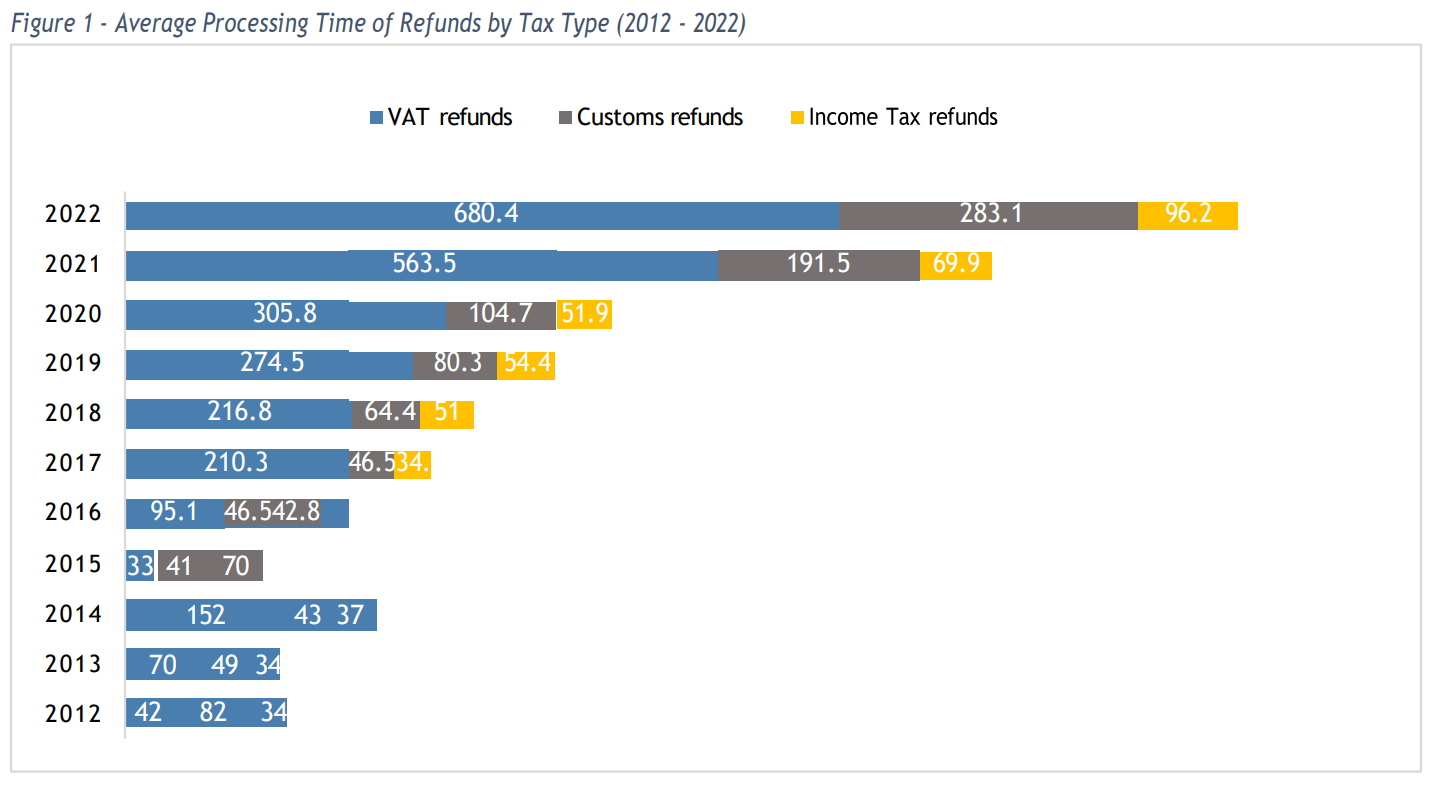

A key feature of the VAT system is its refund mechanism, where businesses reclaim the difference when the VAT paid on inputs exceeds that collected from sales. However, Zambian manufacturers wait an average of 845 days to receive their refunds, far exceeding the Zambia Revenue Authority’s (ZRA) standard processing time of 30 days. As of 2023, the backlog of VAT refund claims stood at an estimated K49.4 billion.

The delayed refunds are significantly impacting manufacturers’ cash flows, forcing them to divert resources from growth-orientated investments to operational survival. According to ZAM , over 74% of surveyed manufacturers reported cash flow difficulties, affecting their ability to purchase raw materials, reinvest in operations, or pay employees. Many manufacturers are forced to turn to alternative financing options, such as loans or overdrafts, further increasing their financial vulnerability.

Production disruptions are another widespread consequence. Without timely refunds, manufacturers cannot stockpile raw materials or fulfil large orders. This has also stalled expansion plans, with some indicating they had to abandon projects aimed at increasing production capacity due to liquidity constraints.

Although the ZRA has introduced measures like the "first in, first out" refund principle and the SMART Invoicing system, these have done little to address the underlying challenges. The limited resources allocated for VAT refunds and the inefficient audit processes are primary culprits. Refunds are paid out of the central treasury, requiring ZRA to negotiate allocations annually, leaving little room for flexibility. Meanwhile, audits remain cumbersome and time-consuming, further delaying payments.

The manufacturing sector’s challenges are compounded by the perception of unequal prioritisation. Sectors such as mining often receive their refunds more promptly, leaving manufacturers at a disadvantage. This perceived inequity exacerbates frustrations within the sector, already grappling with compliance costs and regulatory hurdles.

To address these issues, the report recommends introducing a securitisation mechanism. This mechanism would convert VAT refund claims beyond a certain age into government bonds, enabling manufacturers to liquidate these bonds on secondary markets and ease cash flow constraints. A securitisation mechanism would provide manufacturers with collateral assets to guarantee borrowing at affordable rates. The report also advocates for risk-based audits to expedite claims and an offset mechanism to reduce direct cash pay-outs.

However, the securitisation of over K49.0 billion VAT refund arears into government bonds could have several disadvantages. Bonds are not immediately liquid on the secondary market, and this may fail to solve the liquidity constraints for businesses. Additionally, the sale on the secondary market would likely occur at a discounted valuation, resulting in financial losses compared to receiving direct cash payments. Manufacturers may also face the additional financial challenge of managing and trading government bond portfolios, especially small manufacturers lacking technical expertise and resources to obtain expert investment advice. Furthermore, securitisation would impose an additional layer of administrative burden on government agencies and the ZRA by creating additional workload for the offices that manage government debt instruments.

Moreover, the issuance of more government bonds to cover VAT refund arrears would increase central government debt, negatively impacting its creditworthiness. This could drive yields up, increasing the cost of government borrowing. The creation of a stock of bonds from arrears would provide manufacturers with a new asset class, enabling them to borrow against it and access alternative funding sources, which could potentially increase the broader money supply and breed inflationary pressures in the general economy.

Zambia's manufacturing sector is crucial to the country's economic diversification and growth agenda. However, without a more efficient VAT refund system, the sector's growth and competitiveness remain under-optimised. The inefficient VAT system has not only deprived the economy of manufacturing investment but also increased the sector's costs through costly short-term financing options for working capital management. Furthermore, delayed VAT refunds result in a rapid erosion of value for manufacturers, as the present value declines significantly due to the high inflation rate and depreciating currency.

Therefore, the Zambian government, ZRA, manufacturers, and all stakeholders must prioritise reforms that transform the VAT refund system from a bottleneck into a catalyst for industrial growth. This must be achieved without merely transferring risk exposure to the already fragile government balance sheet.

Featured Image

2024-01-13

Category: Economic & Business Sectors