Zambia Sugar on Profitability Steroids, Dwarfing Zambia's Entire Banking Sector's Q1 Profit After Tax

18 NOVEMBER 2024 : 12:00AM

Gerald Hamuyayi

Zambia Sugar Plc has defied global economic uncertainty, delivering dazzling financial results for its 2024 financial year. The company achieved record-breaking performance, including a remarkable K2.06 billion profit, cementing its status as a sugar production leader and a vital pillar of Zambia's economy.

Operationally, Zambia Sugar achieved impressive milestones in its 2024 financial year. The company processed a record 3.544 million tonnes of cane, operating at an exceptional 98% capacity utilisation rate of its 3.6 million-tonne installed agricultural plant capacity. This operational efficiency drove a 12% increase in sugar cane supply. Additionally, the firm's manufacturing performance was equally impressive, producing 424,531 tonnes of sugar – a historic high which represents 95% of the plant's annual capacity of 445,000 tonnes.

Zambia Sugar's Chief Executive, Mr. Oswald, described the company's outstanding 2024 financial results as "dreamlike," exclaiming, "Pinch me, I am dreaming." Revenue soared 29% year-on-year to K7.53 billion, driven by a 48.8% surge in domestic sales and favourable export prices. Demand from the Democratic Republic of Congo grew 36.6% in 2024, partially offsetting the 17.4% decline in total export revenue. Furthermore, the company's cost optimisation efforts yielded significant benefits, with sugar cost of sales decreasing substantially. As a result, Zambia Sugar's gross profit margin expanded by 9 percentage points, from 43.7% in 2023 to 52.2% in 2024.

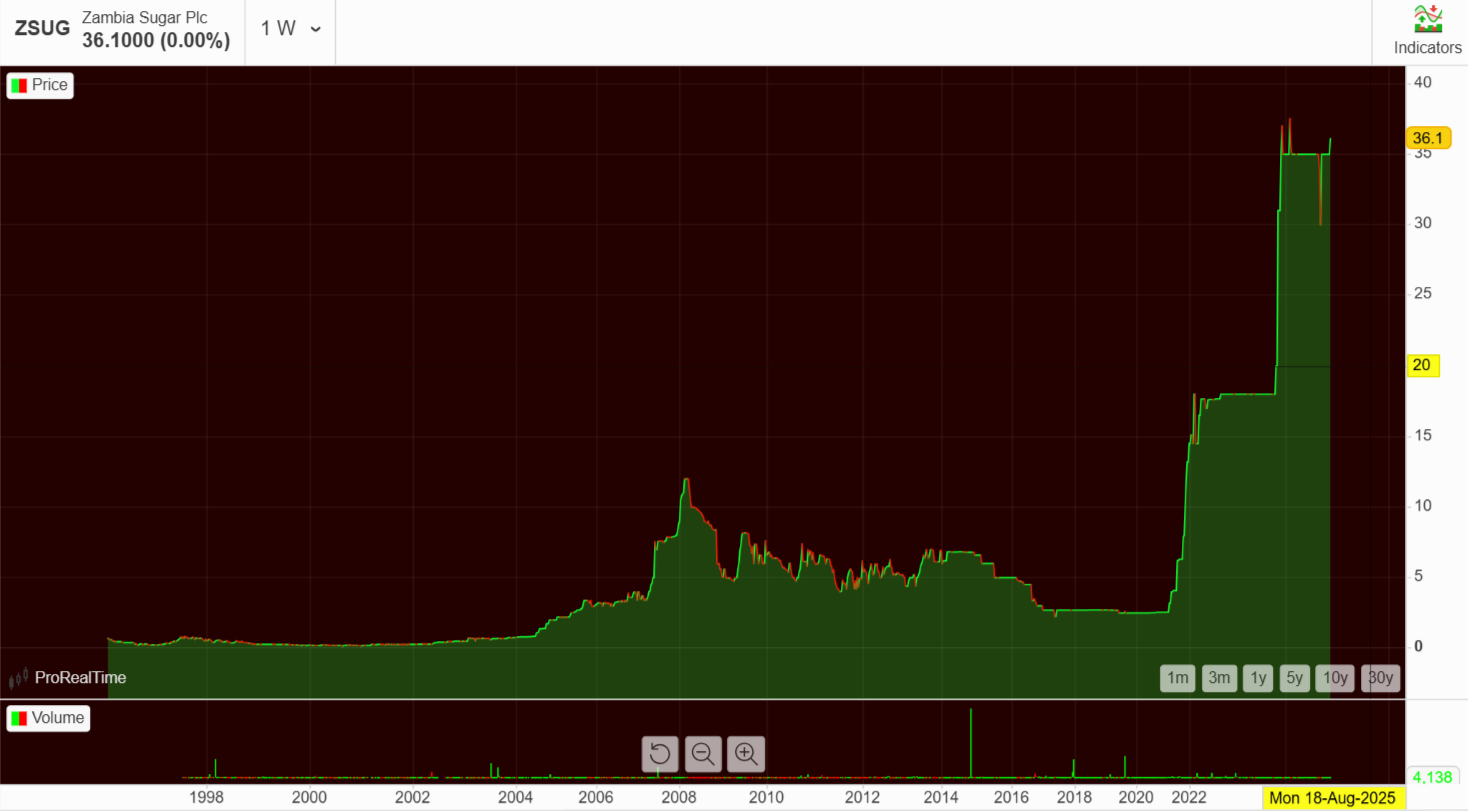

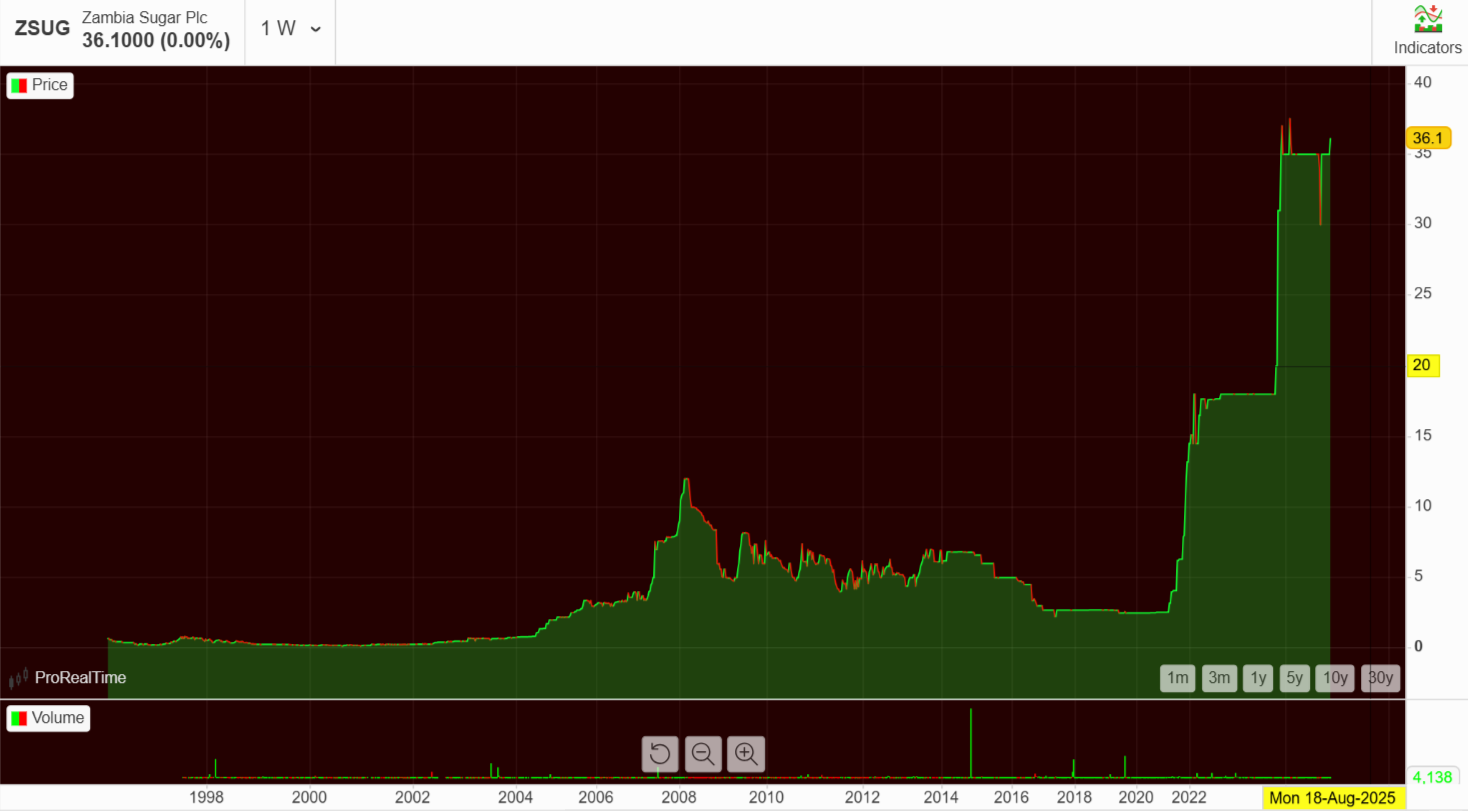

Zambia Sugar Share Price history

Source: Market Screener

Effective energy management played a pivotal role in Zambia Sugar's success, yielding substantial cost savings through innovative power solutions. Notably, the company reduced its national grid demand by 23GWh, leveraging its 40MW captive power generation capacity. This achievement translated into $3.5 million in savings. Currently, Zambia Sugar's annual energy consumption costs are approximately K241 million and the firm remains committed to enhancing operational and cost efficiency, ensuring sustainable energy management practices that drive long-term growth.

Zambia Sugar's 2024 financial year was marked by a phenomenal surge in profitability, with operating profit jumping 105% to K2.57 billion (2023: K1.25 billion) and PAT soaring 120% to K2.06 billion (2023: K0.94 billion). Notably, the company's Profit After Tax (PAT) marginally exceeded the combined PAT of Zambia's entire banking industry in Q1 2024, which stood at K2.00 billion, according to data submitted to the Bank of Zambia. Furthermore, the company's bottom-line margins expanded by 11 percentage points, from 16% in 2023 to 27% in 2024. This significant improvement was driven by successful cost optimisation efforts and favourable pricing in both domestic and export markets.

Zambia Sugar's asset efficiency improved significantly, with total assets increasing from K5.59 billion in 2023 to K7.04 billion in 2024. The company's total asset efficiency ratio stood at 1.19 times, indicating optimal asset utilisation. This ratio, which measures the company's ability to generate revenue from its assets, reveals that for every kwacha invested in assets, Zambia Sugar generated K1.19 in revenue in 2024.

Defying traditional capital asset theories, Zambia Sugar has achieved an optimal capital structure without relying on debt, according to Finance Director Mr. Hezron Musonda. "Contrary to Modigliani and Miller's textbook theories, which advocate for balancing debt and equity to minimise the weighted average cost of capital (WACC), our gearing ratio is virtually non-existent," Mr. Musonda noted. Despite having a strong balance sheet and significant leverage potential, Zambia Sugar has intentionally opted for a conservative unleveraged approach, maintaining a debt-free capital structure. The success of this strategy is spotlighted by the company's impressive interest cover ratio, which has surged 100%, from 33 times in 2023 to 66 times in 2024.

Looking ahead, Zambia Sugar has unveiled ambitious capital expenditure plans to drive long-term growth. The company has allocated K770 million for 2024 and announced a substantial K1.7 billion planned capital investment for 2025. This investment will focus on several strategic initiatives, including the development of the Mazabuka project, significant upgrades to irrigation systems, and targeted investments in plant operational excellence.

To fund these growth initiatives, Zambia Sugar has reduced its 2024 proposed dividend payout to K1.61 per share, compared to the previous total dividend of K3.41 per share, which included a K1.58 special dividend. The company's commitment to shareholder value remains unwavering, having paid a record-breaking dividend of K1.10 billion in 2023 – the highest ever paid by a listed entity on the Lusaka Securities Exchange.

Featured Image

2024-11-18

Category: Economic & Business Sectors