ZCCM-IH Deploys $36 Million USD to Electrify Every Constituency Through New Energy Vehicle

2 FEBRUARY 2026 : 05:14PM

Mozel Chimuka

.png)

Mozel Chimuka, AgoraVillage, AfricaWorks | 28 January 2026 — Zambia has decided to bypass its hydroelectric addiction by scattering renewable energy installations across every corner of the republic, financing the venture with mining dividends and government borrowing. The Presidential Constituency Energy Initiative, crystallised into corporate form through Zambia National Energy Corporation Limited, targets 312 megawatts of distributed generation—enough to power nearly half a million rural homes if executed without the usual infrastructure paralysis. ZCCM-IH, historically tethered to copper revenues and equity stakes in extractive industries, now finds itself managing solar arrays alongside its mining portfolio, a strategic pivot that either diversifies risk or doubles down on capital allocation bets depending on whom you ask in the investment community.

A Special Purpose Vehicle Born from Fiscal Urgency

The incorporation papers for Zambia National Energy Corporation Limited (ZNEC) bear the date 12 December 2025, barely three weeks after Cabinet granted approval for the Presidential Constituency Energy Initiative (PCEI) on 24 November. Speed matters when load-shedding schedules have become a permanent feature of economic planning and the Kariba Dam reservoir remains deeply vulnerable to unpredictable rain and water levels caused by climate change. ZCCM-IH and the Ministry of Finance and National Planning (MoFNP) established ZNEC as a Special Purpose Vehicle designed specifically for energy investment and delivery, a structure that promises commercial discipline and transparency while functioning as the operational arm for nationally significant energy projects.

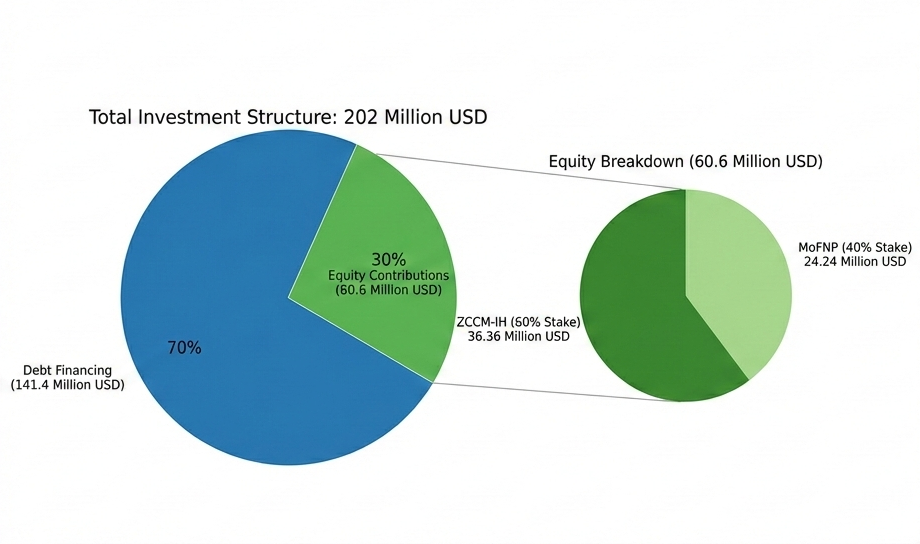

The financial architecture reflects both ambition and realism. Total investment cost sits at 202 million USD, structured with 70% debt financing of 141.4 million USD and 30% equity contributions totalling 60.6 million USD. ZCCM-IH commits 36.36 million USD for 60% ownership while MoFNP contributes 24.24 million USD for the remaining 40% stake. The mining conglomerate's equity injection represents 2.64% of its market capitalisation as of 12 January 2026.

ZNEC's mandate extends beyond simple capital deployment. The entity assumes responsibility for end-to-end project coordination spanning identification, feasibility assessment, capital structuring, financing, execution, and oversight. Working alongside government institutions, financial entities, independent power producers, and private sector participants, ZNEC is tasked with attracting capital, mitigating project risks, and ensuring efficient delivery while adhering to international best practices in governance and financial management.

Distributed Generation as Policy Response

The PCEI targets two megawatts of installed renewable capacity per constituency across all 156 parliamentary districts, yielding a cumulative 312 megawatts of generation. This distributed approach represents a sharp departure from Zambia's historical reliance on large-scale hydroelectric infrastructure concentrated at Kariba and Kafue Gorge. Rather than betting on another massive dam or centralised thermal plant, the initiative scatters generation assets across the national territory, potentially reducing transmission losses and enhancing energy security in areas where grid connection has remained perpetually deferred.

Rural electrification rates in Zambia have remained in single digits for decades, reaching only 8.1% as of 2024, constrained by the economics of extending transmission infrastructure across vast distances to serve dispersed populations with limited purchasing power. Localised solar installations bypass these constraints, offering the possibility of standalone or mini-grid solutions that provide reliable electricity without requiring connection to the national transmission network. At roughly USD 647,000 per megawatt based on the total project cost, ZNEC faces the challenge of replicating these economics across 156 geographically dispersed sites while managing construction logistics, local permitting, and community engagement—execution variables that will ultimately determine whether distributed solar succeeds where centralised infrastructure has failed.

Governance Questions and Strategic Positioning

Because MoFNP holds equity stakes in both ZCCM-IH and the newly formed ZNEC, the transaction qualifies as a Small Related Party Transaction under Section 10 of the Lusaka Securities Exchange (LuSE) Listing Rules. This categorisation ordinarily requires an Independent Fairness Opinion from a professional expert confirming the transaction serves shareholder interests. ZCCM-IH obtained a waiver from LuSE permitting deferral of this opinion for up to six months to accommodate procurement processes mandated under the Public Procurement Act.

The deferral introduces timing risk for minority shareholders. By the time an independent expert renders judgment on fairness, capital will have been committed, and project execution will likely be underway. Should the eventual assessment conclude the transaction is unfair to ZCCM-IH shareholders, the company must seek formal shareholder approval and implement corrective measures, but reversing momentum at that stage becomes exponentially more difficult than securing proper approval before capital deployment.

ZCCM-IH's investment serves multiple strategic objectives. The company diversifies its portfolio beyond mining equity stakes while capturing a foothold in Zambia's energy transition.

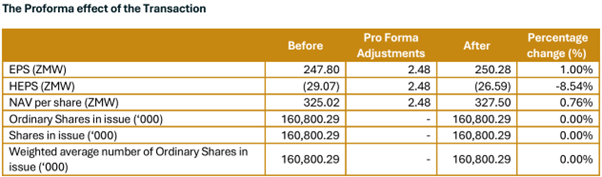

The company projects modest positive effects from the ZNEC investment: earnings per share increasing by 1% from ZMW 247.80 to ZMW 250.28 and net asset value per share rising 0.76% from ZMW 325.02 to ZMW 327.50. Yet these proforma figures capture only the direct returns from ZNEC's operations. The structure also creates a self-reinforcing dynamic: as ZNEC delivers more reliable, affordable electricity across constituencies, the mining companies in ZCCM-IH's existing portfolio—many of which grapple with power costs and load-shedding disruptions—stand to reduce operational expenses and improve margins, generating stronger dividends back to ZCCM-IH as a shareholder. The energy investment thereby supports the mining investments rather than merely diversifying away from them.

The investment adds renewable energy assets to ZCCM-IH's portfolio, creating potentially stable cash flows through long-term power purchase agreements while simultaneously strengthening returns from existing mining holdings. Whether this diversification strategy ultimately validates itself depends on execution competence, stable governance frameworks, and the commercial viability of distributed renewable generation in the Zambian context—variables that defy confident prediction but reward careful monitoring as the initiative unfolds.

Featured Image

Category: Economic and Business Sectors