Bank of Zambia Slashes Borrowing Cost as Inflation Rate Crashes Toward Government Target

7 MARCH 2026 : 11:28AM

Mozel Chimuka

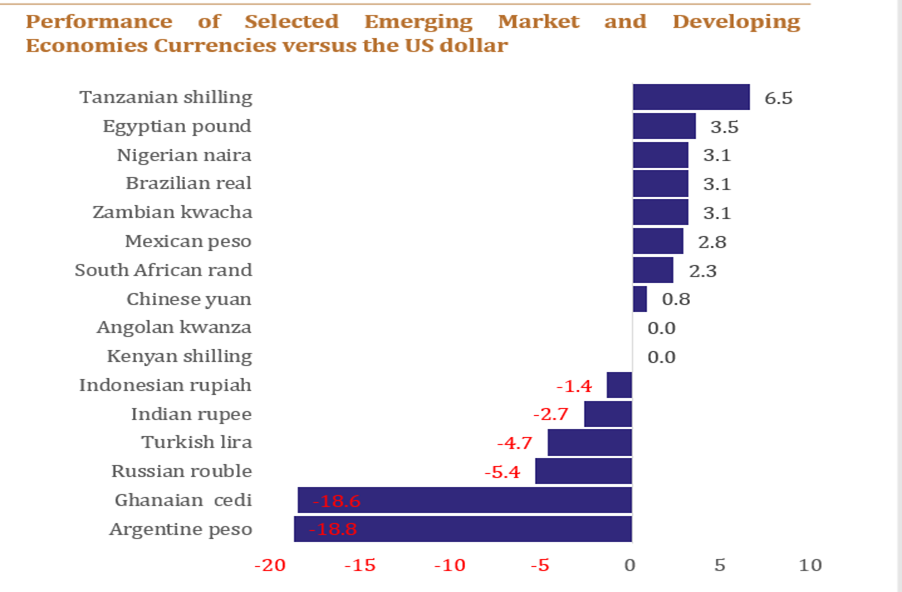

Mozel Chimuka, Agora Village, AfricaWorks, LUSAKA | 12 November 2025 — The US dollar demolished Ghana's cedi—down by 18.6%. Obliterated Argentina's peso by 18.8%. Then it hit the Zambian Kwacha. It was a different story, the underdog surged. Kwacha strengthened 3.1% in Q3 alone, turning the tables on a currency that was supposed to be unstoppable.

In nine months, the economy pulled off what most developing nations struggle to accomplish in years: inflation dragged down from 16.7% to 11.9%, foreign reserves surging to $5.2bn, a half-billion-dollar current account deficit flipped to surplus. Food prices that had terrorised households retreated as three million metric tons of maize flooded markets. The currency that often bleeds appreciated against the mighty dollar.

Yesterday, November 12, the Monetary Policy Committee slashed its benchmark rate by 25 basis points from 14.5% to 14.25%—a modest cut that masks an extraordinary reality. A nation that had been rationing reserves now heads towards economic paradise. An economy that is learning to weaponise its copper wealth, accumulating gold ounce by ounce, and transforming agricultural abundance into an achievement for sub-Saharan Africa.

Currency Strength Defies Regional Collapse

The Kwacha's appreciation stands as the headline achievement in an economic turnaround that defied every pessimistic forecast. While currencies across most emerging markets buckled under dollar, Zambia's currency gained 3.1% against the greenback in the third quarter alone, then surged another 3.9% in October. The performance places the Kwacha among emerging markets’ elite currencies, outpacing the Kenyan shilling and leaving regional peers gasping as the Argentine peso collapsed 18.8% and the Ghanaian cedi fell 18.6%..

source: Bank of Zambia

Mining sector discipline powered this currency resilience. Copper producers supplied a net USD 440.5m directly to markets in the third quarter, with another USD 196.3m flowing to the Bank of Zambia (BOZ) for tax obligations. This cemented the sector's role as the economy's foreign exchange anchor, creating supply cushions that allowed selective rather than desperate intervention. The BOZ provided USD 120m to markets during the quarter to moderate volatility, while excess demand fell to just USD 24m from USD 156m in the second quarter.

Reserve Accumulation and the Gold Strategy

Behind the currency stability lies strategic reserve accumulation that began years before inflation started descending. Gross international reserves reached USD 5.2bn at end-September, equivalent to 5.2 months of import cover, fuelled by a USD 191.1m disbursement under the International Monetary Fund's (IMF) Extended Credit Facility arrangement, project receipts, and interest earnings.

The central bank's gold accumulation program represents its most unconventional yet effective strategy. Since December 2020, the BOZ has purchased 3,051.3kg of locally produced gold, now valued at USD 396.3m with gold trading at USD 4,115.68 per ounce. The third quarter alone saw purchases of 186.62kg worth USD 21.5m. This patient accumulation will provide a hedge during currency turbulence and diversify reserves beyond traditional dollar holdings.

Food Prices Surrender to Agricultural Success

The bumper maize harvest quietly dismantled one of inflation's most stubborn components. Food inflation retreated to 14.6% by September from 18.9% in the first quarter as maize grain and maize meal prices fell sharply. Non-food inflation dropped even faster to 9% from over 13%, with transport costs declining as fuel prices stabilised and housing costs benefiting from currency appreciation.

The inflation projections now chart a credible path toward the BOZ's 6% to 8% target band. The central bank revised its 2025 average inflation forecast slightly upward to 13.8%, acknowledging slower food price declines, but the 2026 outlook improved to 7.6%, with inflation expected to average 6.6% across the first three quarters of 2027. Lagged effects of Kwacha appreciation, lower fuel prices, and residential electricity tariff reductions underpin these projections.

Current Account Reversal and Export Diversification

One of the indicators that captures Zambia's transformation more dramatically is the current account’s swing from a USD 0.5bn deficit in the second quarter to a USD 0.03bn surplus in the third. Exports surged 22.1% to USD 3.7bn, with copper leading but non-traditional exports emerging as genuine contributors. Maize exports capitalised on regional food deficits, burley tobacco found international buyers, and electrical cables reflected growing manufacturing capacity.

Imports grew 11.8% to USD 3.1bn, but composition revealed healthy economic activity. Intermediate and capital goods dominated import growth, particularly industrial boilers, electrical machinery, and motor vehicles. The Kwacha's appreciation made imported equipment more affordable, encouraging businesses to upgrade production capacity.

Measured Optimism and Remaining Challenges

The MPC's decision to cut rates by merely 25 basis points to 14.25%, despite inflation's descent, signals persistent caution. Inflation remains nearly four percentage points above the target band's upper limit, and market expectations stay elevated despite improvement. Credit growth accelerated to 17.4% year-on-year in September, with private sector credit expanding 21.4% concentrated in electricity, transport, agriculture, and manufacturing sectors.

Business sentiment surveys confirm improving conditions. The Stanbic Bank Zambia Purchasing Managers Index registered 52.1 in September, indicating expansion, while the BOZ's Quarterly Survey of Business Opinions and Expectations showed gains in output, sales, and profitability. Growth prospects over the medium term appear genuinely bright, with ICT, mining, agriculture, tourism, and construction sectors showing expansion capacity.

The rate cut marks an inflection point, and the world should be paying attention. Zambia is writing its own recovery playbook—one that every struggling emerging market could learn from: reversing a currency crisis, cutting inflation from 16.7% to 11.9% in just nine months, and rebuilding reserves with patience and discipline. The strategic use of commodity wealth has been weaponised, monetary policy executed with discipline, and inflation continues to fall as currency stability becomes more entrenched. Only time will tell whether this remarkable performance proves to be a fleeting moment or the foundation of a lasting turnaround.

Featured Image

Category: Policy and Development