Weatherproofing Zambia's Power

27 AUGUST 2024 : 12:00AM

Gerald Hamuyayi

A well-known old adage states: “Don’t put all your eggs in one basket.” Yet for Zambia, the timeless words of Miguel de Cervantes might as well have fallen on deaf national ears. The country's huge power deficit headlining 950MW has plunged its citizens into darkness, exposing the devastating consequences of putting all its energy eggs in one hydro-vulnerable basket. Diversification, a cornerstone of risk management in entrepreneurship, finance, and many spheres of life has never been more critical for Zambia’s energy sector.

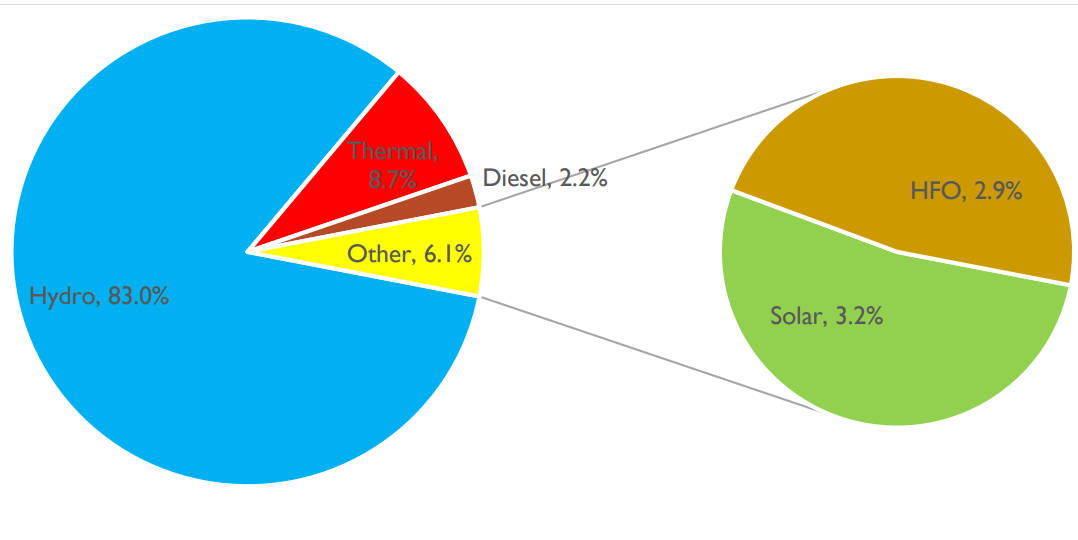

According to the Energy Regulation Board’s Energy Sector Report, Zambia’s total installed electricity generation capacity stood at 3,811.3MW as at end of 2023. This comprised of 3,164.14 MW hydro, 300 MW thermo, 122.38 MW solar, 110 MW Heavy Fuel Oil (HFO) and 84.80 MW diesel. As illustrated in the ‘Installed electricity generation by technology – 2023” graph, hydro power accounted for 83% of total installed. This precariously undiversified energy mix has left Zambia's energy security susceptible to rainfall variability, and the ticking time bomb has finally exploded, disrupting the energy supply, livelihoods, and the broader economy.

Source: Energy Regulation Board

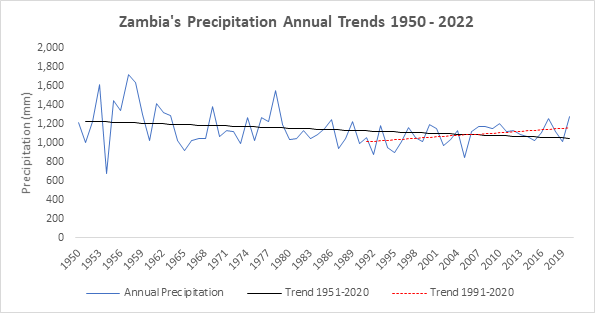

Despite growing investment in Zambia's hydroelectric generation capacity, long-term rainfall trends have been declining since 1950, according to the World Bank’s Climate Change Portal. On average, annual precipitation has decreased by 2.60 mm per year, significantly dropping from approximately 1,230 mm in 1951 to around 1,050 mm by 2020, as illustrated in the “Zambia Precipitation Annual Trends 1950-2022” chart.

Courtesy of World Bank’s Climate Change Portal

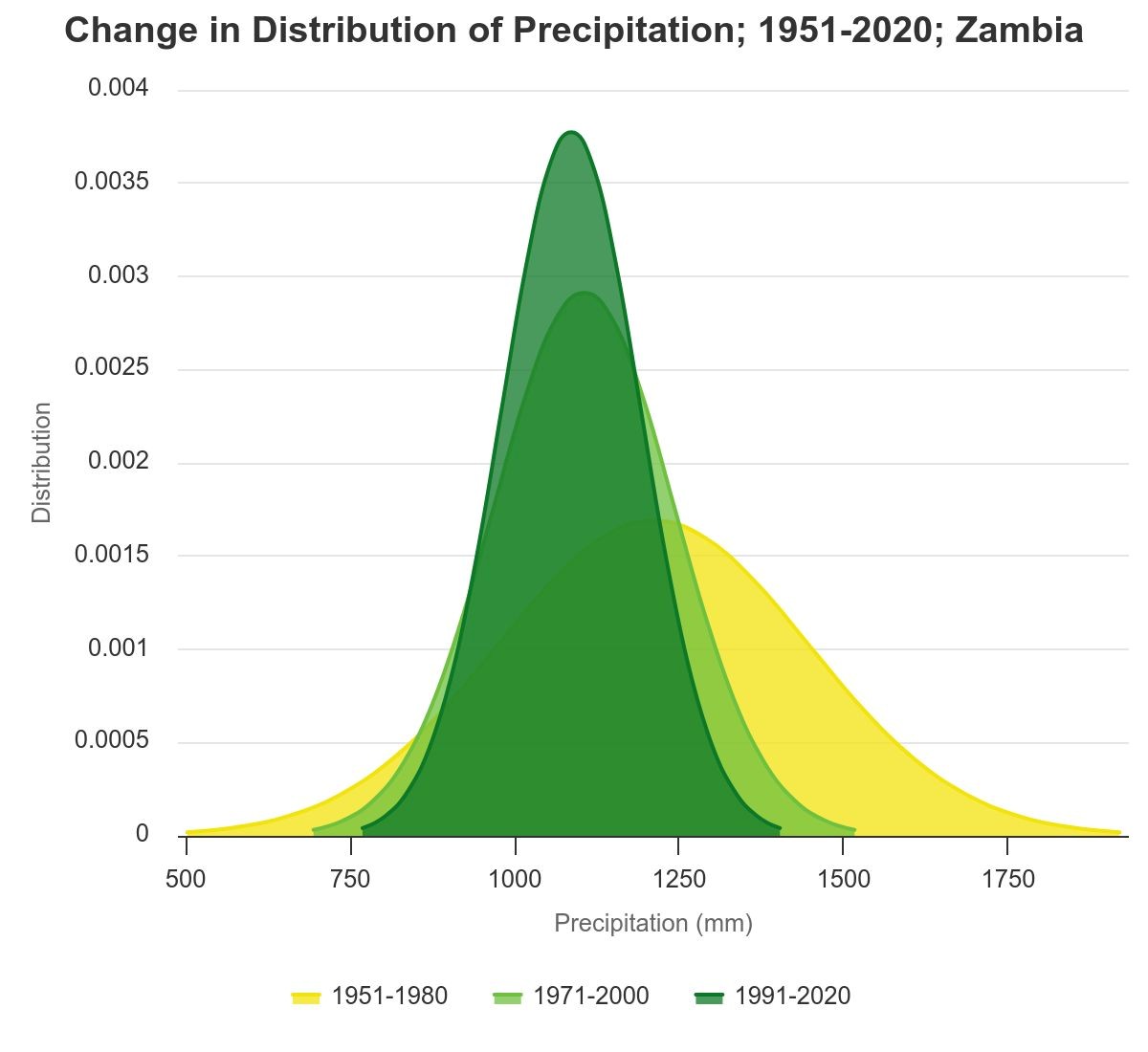

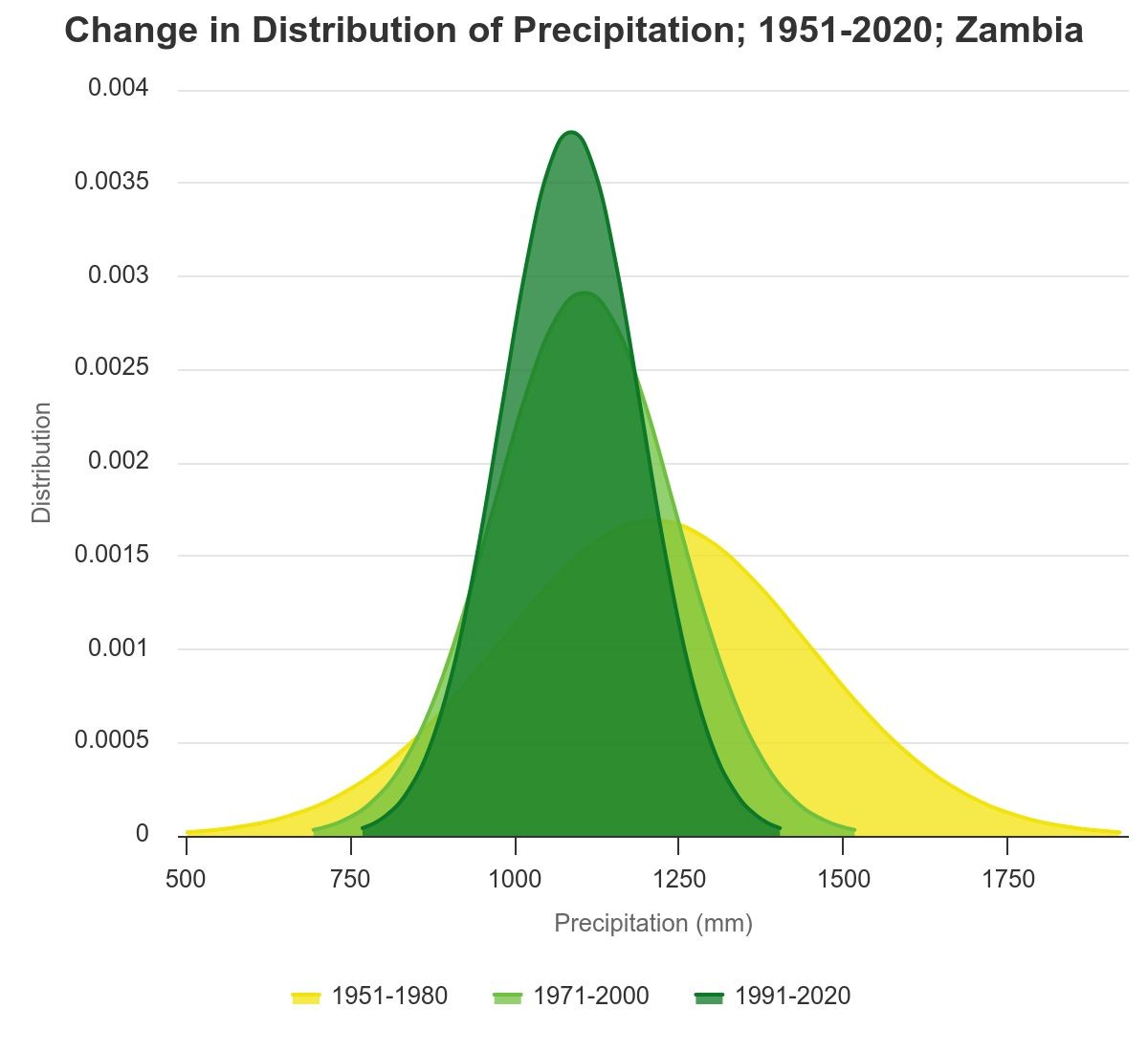

The "Change in Distribution of Precipitation 1951-2020" graph highlights the negative impact of climate change on Zambia's precipitation patterns. Zambia's rainfall has undergone significant shifts, since the 1950s. From an average of 1,210.75 mm in the thirty years from 1951 to 1980, rainfall declined by 9% to 1,105.35 mm by 2000 and a further 2% by 2020. Notably, the precipitation distribution exhibits a considerable shift, characterised by a declining variance in precipitation levels over time, with both precipitation amounts and variability trending downwards, indicating lower rainfall expectations and diminishing probabilities of heavy rainfall events.

Courtesy of World Bank’s Climate Change Portal

The climatic conditions discussed expose the vulnerability of Zambia's energy sector to hydro concentration risk, given the evolving climate. Despite significant investment in hydro-electric technology, energy players seem to be "barking up the wrong tree", an endeavour that contradicts historical precipitation data, as underscored. A shift in investment focus towards diversified energy sources could be Zambia's energy game-changer.

Regional Diversification

The Southern Province of Zambia hosts approximately 93% of the national hydroelectric generation capacity, with 99% of this capacity situated within the Zambezi catchment area. Despite the Southern Province's invaluable water resources, the increasing frequency and intensity of droughts over time pose a significant risk to Zambia's energy security. Regional diversification of power production, aligned with Zambia's Integrated Resource Plan, is a strategic move that optimises rainfall resources across Zambian territory while mitigating the regional impact of droughts on power generation.

This is because the adverse impact of drought in one area can be mitigated by potentially abundant rainfall in another region. Deploying hydro technology in the northern circuit aligns perfectly with Zambia's plan, providing a crucial weather-hedge against rainfall underperformance in southern Zambia. According to the energy resource map the Luapula and Northern Provinces collectively possess approximately 1,386 MW of untapped hydro potential.

Diversification of Energy Sources

Diversifying energy sources enables a society to absorb shocks in one energy input, such as hydro, by increasing reliance on another, like solar, nuclear, gas, heavy fuel, or coal. As previously highlighted, approximately 83% of Zambia's national electricity capacity is hydro-based, despite declining precipitation levels over the years. Fossil fuels accounted for 13.8% of Zambia's installed national capacity in 2023. Total power generation from fossil fuels reached 2,135.03 GWh, compared to the total generation of 19,372.92 GWh. According to Earth.org, 2023 was the hottest year on record, with fossil fuels comprising 82% of the global energy mix. Moreover, global primary energy consumption hit historic highs that year, with oil and coal dominating the energy mix.

Curtesy of Maamba Collieries Ltd web

Coal, solar, wind, and nuclear energy present significant potential for development and scalability in Zambia. Diversifying into these energy sources would mitigate hydro-related weather risks. As noted in the previous article, "Ending Zambia's Electricity Eclipse – A Regulatory Perspective," a critical aspect often overlooked in energy discussions is that; "it is not just about addressing climate change through transitioning to more renewable sources, but also ensuring our energy infrastructure and systems are resilient and reliable in the face of a changing climate." Link to article below

Diversifying Energy Consumption[GH8]

With ZESCO announcing an impending 300MW energy deficit due to a shutdown of Kariba Hydro Power Station, caused by low water levels, load shedding is expected to worsen. Prolonged blackout hours will not only exacerbate the existing energy poverty affecting Zambians but also fuel inflationary pressures as businesses resort to more expensive alternative power sources.

Liquefied Petroleum Gas (LPG) is a viable alternative cooking fuel for most income groups. LPG's versatility, including its ability to power gas refrigerators at a lower cost, enhances its appeal as a viable alternative. This switch alone would significantly reduce the load on the grid, boosting Zambia's energy security.

Source: Energy Regulation Board

As more Zambians switch to gas, demand for LPG has significantly increased. The surge has led to mild gas shortages in the country. This situation has been exacerbated by the absence of domestic production and inadequate storage facilities for LPG. To meet this demand and tap into the new market, energy players are considering developing storage and production facilities. Until supply chain disruptions are addressed, challenges persist in shifting energy demand away from the grid through LPG.

Despite its intermittency, solar power is another option that could offer decent electricity for consumers. The availability of smaller unit solar panels with battery storage makes them ideal for providing energy for lighting and low-load appliances in homes. For high-income households, more advanced solar energy solutions are accessible, enabling them to generate surplus energy beyond their requirements. This, in turn, creates an opportunity for HIHs to reduce power costs and generate additional income through selling excess power back to the national grid via open access.

Courtesy of Microsoft Office Clip Art/Bing Images

Featured Image

2024-08-27

Category: Economic & Business Sectors