Banks Rake in the Cash as Recession Fears Loom

29 MAY 2024 : 12:00AM

Gerald Hamuyayi

Defying the odds, Zambia's banking sector posted a mega K2.0 billion profit after tax in Q1 2024, amidst a crossfire of economic headwinds. Despite worsening business conditions, power load shedding, soaring inflation, a tumbling currency, and rising interest rates, the sector's superior financial results suggest its resilience. Banking profitability is now facing a new hurdle on the interest rate frontier following the recent 100-basis-point hike in the benchmark rate to 13.5% by the Bank of Zambia's Monetary Policy Committee.

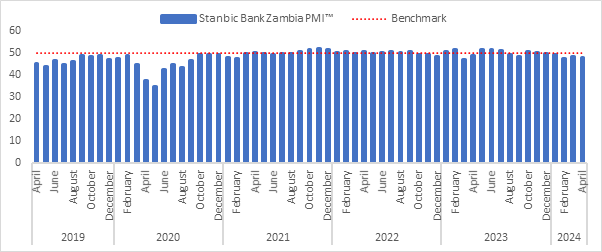

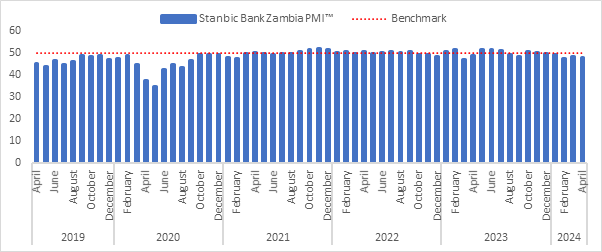

In April, Zambia’s private sector pulse contracted as measured by the Stanbic Zambia Purchasing Managers Index (PMI), which headlined 47.7 in April, down from 48.8 in March. Note that a PMI reading above 50 signals a growing private sector, while a reading below 50 indicates contraction. The Zambian PMI has expanded in only 5 of the last 12 months, as low consumer demand, a depreciating kwacha, and reduced money circulation weigh on business conditions. On the upside, staffing levels improved in April, stemming from increased business confidence at the start of Q2.

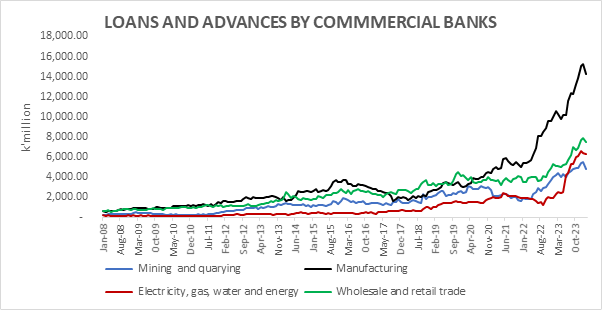

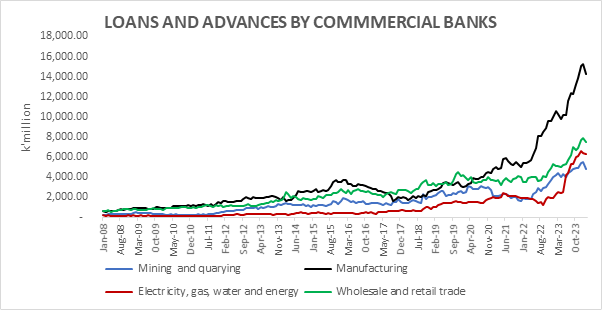

Since 2020, the financial sector has increased its risk exposure to the private sector through increased lending, as depicted in the 'Loans and Advances by Commercial Banks' chart. However, despite this, the manufacturing sector has struggled to break sustainably out of the contractionary zone, as indicated by the Stanbic Bank PMI. While unfavourable economic fundamentals may be contributing to this relationship, a deeper analysis is warranted to understand the possibility of distressed borrowing in the private sector impeding its growth. This investigation would help understand underlying factors, constraints and risks.

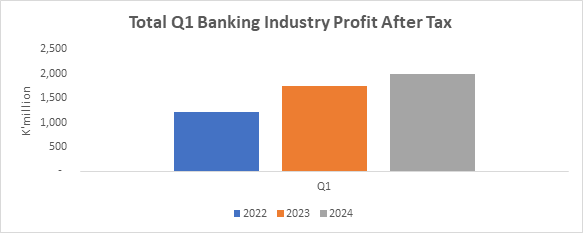

Amidst challenging economic conditions, the Zambian banking sector demonstrated robust resilience and growth, achieving a significant profit after tax (PAT) of K2.0 billion in the first quarter of 2024. This profitability level represents a 13.8% increase from K1.8 billion in the same period last year as shown in ‘Total Q1 Banking Industry Profit After Tax’ graph. However, quarter one PAT ebbed 13.6% following a record K2.3 billion recorded the previous quarter.

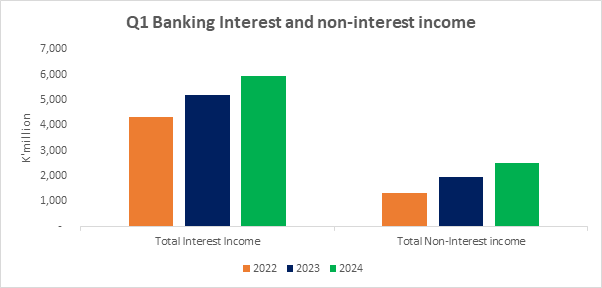

The sector also saw an increase in interest income, rising from K5.2 billion in 2023Q1 to K5.9 billion in 2024Q1. However, the growth rate of total interest income eased from 20.1% in 2023Q1 to 14.7% in 2024Q1. Additionally, non-interest income in Q1 grew by 27.8% to K2.5 billion in 2024, up from K2.0 billion in 2023Q1, easing from 46.3% growth recorded in 2023Q1 relative to 2022Q1.

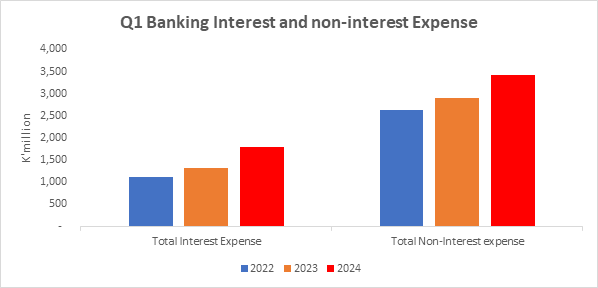

However, cost structures remain elevated in the sector, with both interest and non-interest expenses showing significant growth. Interest expense in 2024Q1 surged by 35.4% to K1.8 billion, up from K1.3 billion in 2023Q1, outpacing the 19.4% growth recorded in 2023. Similarly, non-interest expense in 2024Q1 increased by 17.5% to K3.4 billion, up from K2.9 billion in 2023Q1, above the 10.2% growth rate in 2023 as illustrated in the figure ‘Q1 Banking Interest and non-interest Expense.’

Compared to 2023Q4, total interest income marginally declined by 0.2% in 2024Q1 while total interest expenses also rose by 24.3%. On the upside, non-interest income rose by 15.8% with non-interest expenses also rising by 3.5%. The non-interest income segments banks remain key income drivers amidst the current liquidity crunch arising from elevated interest rates.

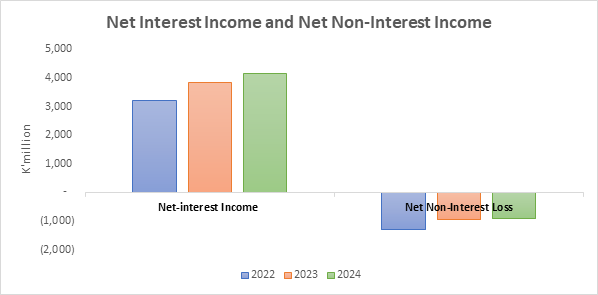

The sector's growth in interest and non-interest earnings suggests its robustness in mobilising revenue streams. Although the non-interest activities section of the banking sector typically incurred losses (as is usually the case in the banking sector) in all quarters as shown in the ‘Net Interest Income and Net Non-Interest Income’ chart, the banks have been bridging the gap, as indicated by the reducing non-interest income losses from K1.3 billion to K0.95 billion and further down to K0.917 billion in 2022, 2023, and 2024, respectively.

As economic challenges intensify, risk management teams play a vital role in ensuring optimal asset and liability management in banks. Amidst Zambia's power crisis, soaring inflation, high interest rates, and currency depreciation, banks must boost their provisions for loan losses, mitigate other potential losses, and optimise risk exposures to ensure adequate capitalisation. In a credit-constrained environment, utilisation of internally generated funds while reducing reliance on costly short-term lending becomes a prudent strategy. This approach minimises systemic risks that could arise from defaults and ultimately contributes to the overall financial stability.

Featured Image

2024-05-29

Category: Economic & Business Sectors